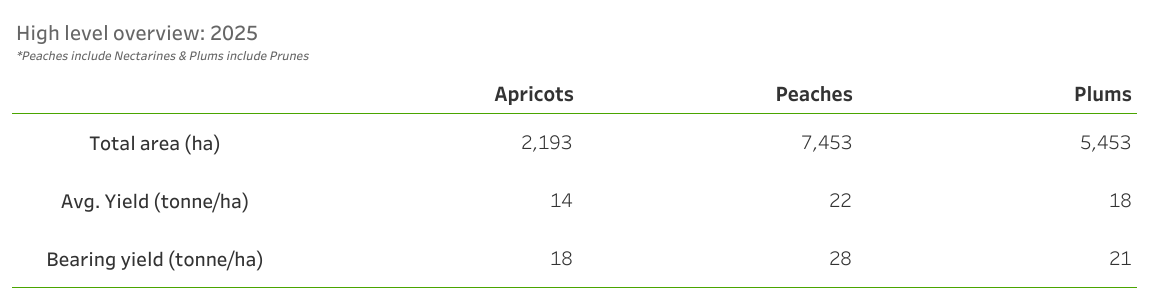

Stone Fruit Key Summary Statistics

Summary Statistics

Production area and yield

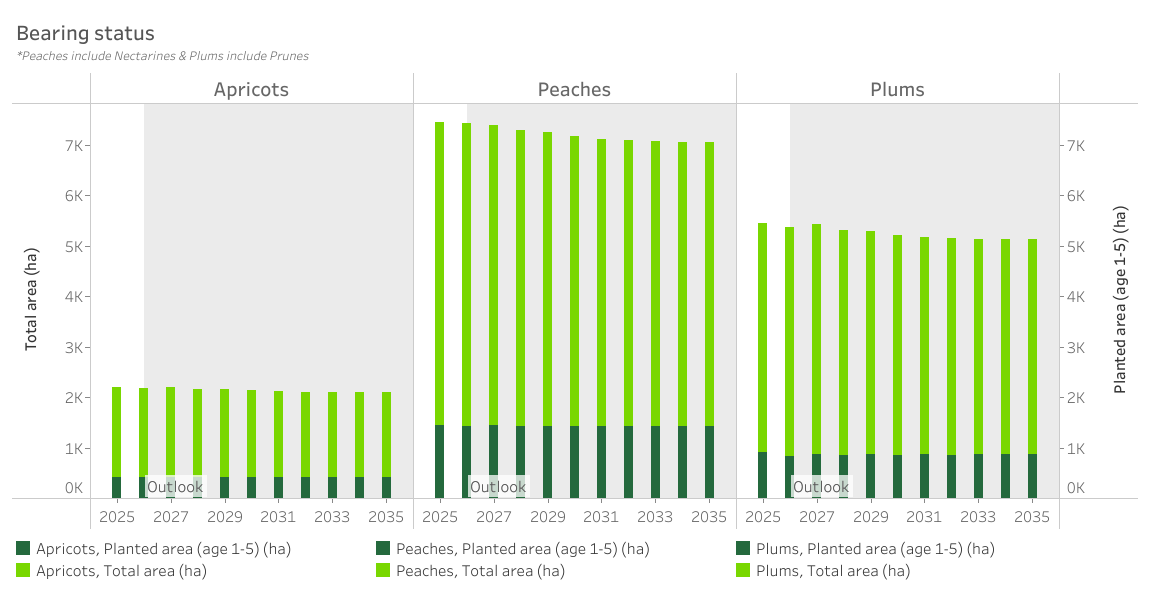

Whereas a slow and continuous decline in area is observed for apricots and peaches, plum area only seen a drop in hectares recently. The lack of sustainable returns contributed to these changes. Over the outlook period, apricot area is expected to marginally decline as some orchards would become unproductive, but the establishment of newer cultivars in certain areas provide producers reasonable returns based on fair yields, good pack out percentages and well positioned marketing windows would slow down the rate of the decline. For plums and peaches, the downwards trend on area is expected to continue over the first half of the outlook period as the processing marketing channel continues to be constrained for peaches and the change in the US market could put pressure on plum margins. While nectarine area expanded exponentially (average annual rate of 7% since 2019), the tempo is expected to slow down and normalise of the outlook period.

Bearing status

The rate of replacement varies across crops, producers, and regions, but the overall trend is a decline in the non-bearing component on farms. In some cases, this reflects a move toward normalization (an optimal ratio between non-bearing and bearing trees), while in others, financial constraints have limited the establishment of new orchards, resulting in a higher proportion of bearing trees.

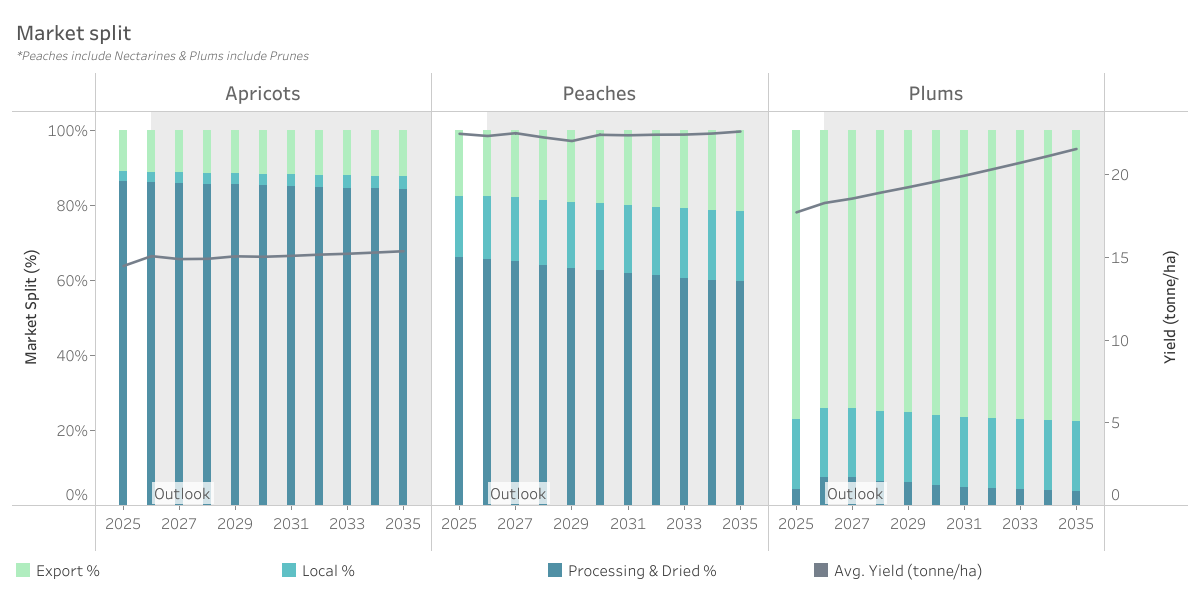

Market split

With processing markets under pressure, efforts to generate sufficient farmgate revenue to cover cost include a focus on improving pack-outs. While it is from a small base, there are potential to expand fresh sales domestically – often case these products are export grade. Cultivar choice in the establishment of new orchards reiterate the focus on packing for fresh sales. At an aggregate level, the continued effort by producers to establish cultivars with better yields and better pack-outs would drive an acceleration in packed volumes over the outlook. However, with higher yields and a unpackable component always present, the processing market when remain an important outlet for products not suitable for fresh sales, but the share of this outlet would decrease over time.

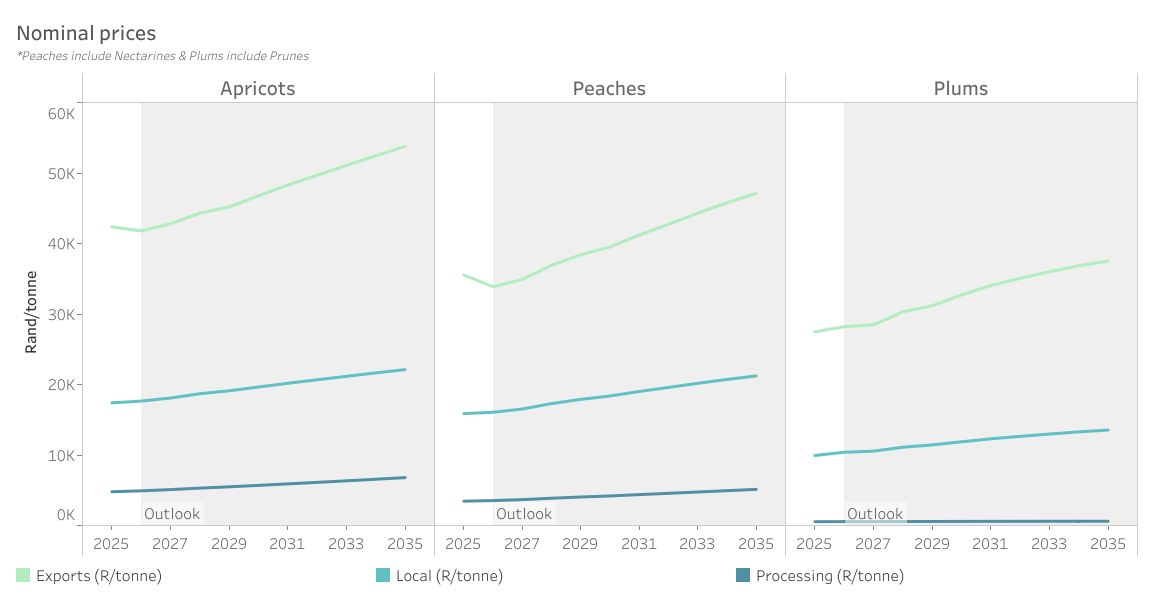

Nominal and real prices

Over the past two seasons, a correction in export and local fresh produce market prices was observed. This comes after a very challenging period in the industry as global logistics disruptions, the invasion of Ukraine by Russia, fluctuating exchange rates and other factors contributed to extensive pressure on producers’ margins. Amidst a new global shift – weakening of key currencies, the net effect on the exchange rate is not favouring producers dependent on a weaker Rand over time to improve farmgate revenue. As a result, in the short to medium term, a slowdown in price changes is expected, which will have a negative impact on profitability. Over the second part of the outlook, the weakening of the Rand is projected to support price improvements. In real terms, a slight decline in prices are projected over the outlook, highlighting the need for yield and/or pack-out improvement to support revenue growth.